The Market Has Spoken: Experienced Hands Needed To Navigate SARS’ Enhanced AIT Process

The market saw mixed reactions following the implementation of the enhanced Approval of International Transfers (AIT) process on 24 April 2023.

On the one hand, there was the tribe aligned with the strategic intent that the AIT process aids in making non-compliance hard and costly. On the other, many were of the mindset that the new AIT process would open a window for the South African Revenue Service (SARS) to further investigate the full extent of taxpayers’ wealth.

The market has finally spoken now that several weeks have passed and professionals have gained a better understanding of the new AIT process.

The main consensus? Navigating the new AIT process is anything but simple and requires experienced hands.

Navigating Tricky Waters

In the weeks following the announcement of the enhanced AIT process, Tax Consulting South Africa has provided technical training sessions to several SARS-recognised controlling bodies, such as the South African Institute of Taxation, and the South African Institute of Professional Accountants.

These sessions, led by Tax Consulting Managing Partner, Jerry Botha, provided a high-level overview of the rationale, as well as potential sanctions for non-compliance. To better highlight the intricacies of the enhanced process, attendees were taken through the required supporting documentation and a step-by-step process of the submission of an AIT application.

Flowing from these training sessions, the consensus from both the market and members of prominent professional bodies can be summarised as this:

Comment from Tax Consulting South Africa Training webinar on the new AIT Process.

Financial Professionals Alliance

Navigating the tax terrain has always been based on a 2-sided coin.

On one side, accountants, tax practitioners, and other financial professionals have operated in silos. This has historically been an attempt at “locking” one’s client list, ensuring business continuity for the foreseeable future.

While on the other, taxpayers have been notorious for attempting tricky processes themselves, and only seeking professional assistance when failed.

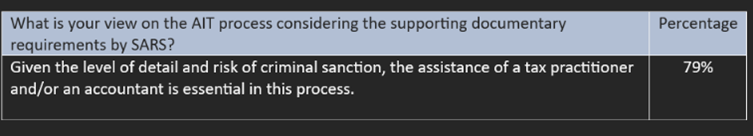

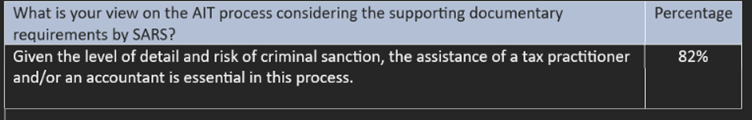

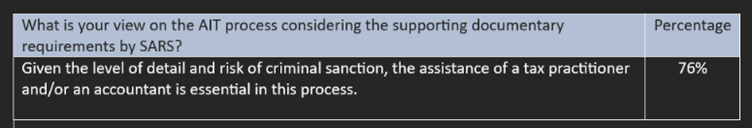

In current times, and more so considering SARS strengthening its tax treatment, navigating the complexities of tax terrain is becoming more complex and demanding. Taxpayers and financial professionals must align with the market and understand that no man is an island. Statistically speaking, per the below census, given the in-depth documentary requirements and risk analysis, professional assistance is essential:

Poll Results from Tax Consulting South Africa Training webinar with SAIPA on the new AIT Process.

Poll Results from Tax Consulting South Africa Training webinar with SAIT on the new AIT Process – first session.

Poll Results from Tax Consulting South Africa Training webinar with SAIT on the new AIT Process – second session.

The Tribes Have Spoken

It has become clear as day that being the sole survivor is no longer an option. To best facilitate the AIT process for taxpayers, tax and financial professionals are now coming together and building on each other’s expertise.

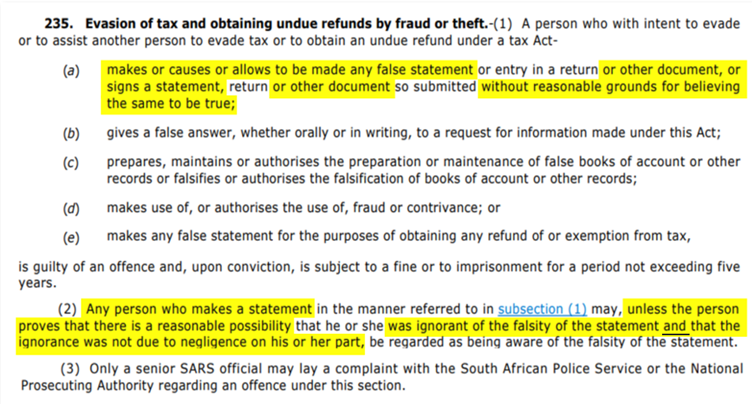

Not only will this foster better business collaboration to gain a larger market share, but it will also ensure strong alliances between professionals. With the increased risk of criminal sanctions under section 235 of the Tax Administration Act, this may be a saving grace for many in the financial sector.

Screenshot of Section 235 of the Tax Administration Act.

Criminal sanction can become the reality for many in an instant when any false statement, intentionally, or inadvertently, is submitted to SARS, accompanying an AIT request. However, with different professionals in your corner, this can be easily mitigated.

At the end of the day, this also ensures in safeguarding your clients.

As a rule of thumb, all correspondence received from SARS should be immediately addressed by a qualified tax specialist or tax attorney. As specialists, they can correctly advise taxpayers on the appropriate, and justifiable amount, the taxpayer qualifies to transfer, which will reduce the chances of a SARS’ rejection of an AIT application.

However, if a taxpayer has already undertaken the disclosure themselves, and a subsequent audit ensues, enlisting seasoned tax attorneys to help navigate the wild waters of the enhanced AIT process, will aid in preventing potential prosecution, whilst fulfilling all documentary requirements.

The First Mover Advantage

Despite the market’s initial mixed reaction to SARS’ enhanced AIT process, the opinion of financial professionals is aligning. This has especially been the case following the training sessions held by Tax Consulting South Africa and SARS-recognised controlling bodies, as they have provided a clearer understanding of the intricacies of the new process.

Most professionals seem to agree that the new, enhanced AIT process is complex and requires the assistance of experienced professionals. In some cases, it may even require the assistance of several financial professionals.

Ultimately, when navigating the new tax terrain, this consensus should be followed. Where taxpayers find themselves in the precarious position of now disclosing previously undeclared interests or foreign income, they should seek the assistance of a seasoned tax or financial professional.