The New

AIT Process

On 24 April 2023, with no fanfare or any prior notification, SARS implemented the enhanced Approval of International Transfers (AIT) process with immediate effect. This change was met with mixed reactions within the financial services sector and taxpayers alike.

The introduction of AIT saw several changes to the Tax Compliance Status (TCS) process, including:

- The consolidation of the “Emigration” TCS pin and the “Foreign Investment Allowance” TCS Pin to create the new “Approval for International Transfer” (AIT) TCS Pin;

- The removal of the Tender option and the need to choose the Good Standing TCS pin for all other scenarios where a 3rd party wants to verify a taxpayer’s compliance;

- The increase in the number of required supporting documents; and

- The need to disclose local and foreign assets and liabilities at cost.

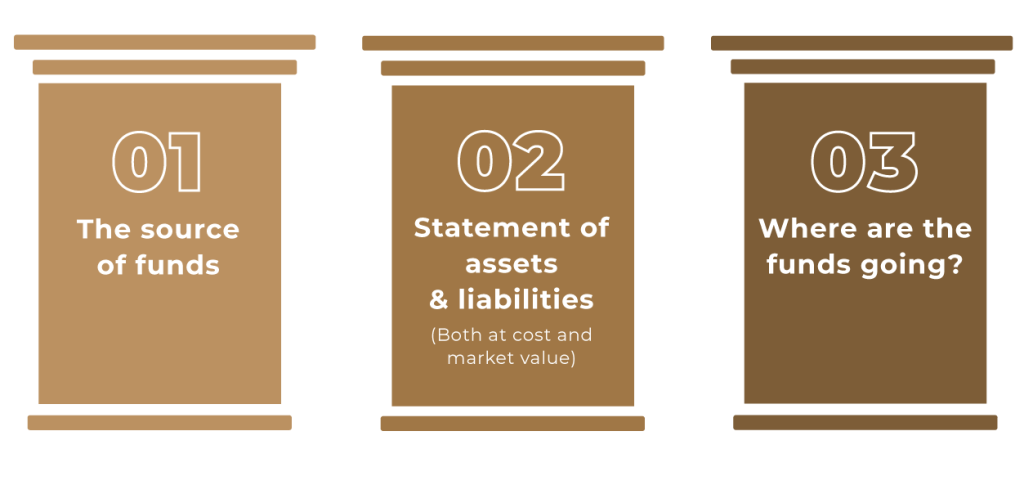

3 PILLARS OF SARS' STRATEGIC INTENT

The new AIT process and the changes SARS has implemented all follow SARS’ strategic intent:

These three pillars all indicate that SARS is following the money…

AIT PROCESS FLOW

STEP 1

Tax Diagnostic

STEP 2

The Risk and Reconciliation Report

STEP 3

The AIT Process

This best practice process flow does mean that you may be in contact with various financial professionals, including tax returns specialists, financial emigration experts, and tax attorneys. Tax Consulting South Africa has a multidisciplinary team of more than 150 professionals across all aspects of the tax industry.

FAQs

Previously, when one sought to either financially emigrate or transfer large sums out of the country, they would either have to complete the “Emigration” TCS Pin or “Foreign Investment Allowance” (“FIA”) TCS Pin, respectively. The new AIT Process consolidates these two and is now the go-to requirement when it comes to the approval of moving funds out of South Africa.

The AIT process applies to both South African tax residents who transfer more than R1 million out of South Africa in a calendar year, as well as for taxpayers who have ceased their tax residency in South Africa but need to move funds abroad, from a South African source, for whom this applies for any amount being remitted.

SARS allows South African tax residents to transfer an amount of R1 million offshore, per calendar year. This amount is known as a single discretionary allowance (SDA) and is available only to individuals who are South African tax residents.

If you are a tax resident, you will require an AIT pin when you seek to transfer more than R1 million out of the country, per calendar year. If you have ceased your tax residency, you will need an AIT pin for every cent you seek to transfer out of South Africa, per calendar year.

There is a usual turnaround time for SARS approval on an AIT application is 21 business days, where no additional information or verification required.

IN THE MEDIA

STEP 01

Tax Diagnostic

STEP 02

The Risk and Reconciliation Report

STEP 03

The AIT Process

This best practice process flow does mean that you may be in contact with various financial professionals, including tax returns specialists, financial emigration experts, and tax attorneys. Tax Consulting South Africa has a multidisciplinary team of more than 150 professionals across all aspects of the tax industry.